Beep Beep

In our minds, one of the most iconic Looney Tunes’ misadventures was the relationship between the Road Runner and Wile E. Coyote. The way the Road Runner always gets the better of the hapless coyote with his classic “Beep Beep” just as Wile E. happens to run off an unforeseen cliff into a deep gorge. Of course, with the delayed suspension midair before gravity suddenly decides to take over. Markets, like Wile E., can be so singularly focused on one thing (inflation) that they can for better or worse be oblivious to approaching danger (recession).

Markets are forward looking; they bottom well before the negative impacts of a recession ripple through the economy. At this point, the hope has been that cooling inflation is all that’s needed for markets to catch a bid. However, with all the focus on inflation (i.e., the Road Runner), markets may be overlooking the real risk of an economic slowdown. We touched on this in our recent Market Outlook.

A synopsis of our outlook thoughts heading into 2023:

2023 should start off decently as inflation comes down a bit more, partially alleviating the markets biggest fear. Plus, a little January effect could certainly help. However, less inflation will start to accelerate slowing corporate earnings. And the wealth effect of falling equity/bond markets over the past year plus delayed economic impact of rate hikes and higher yields will cause economic growth to fall significantly. This could trigger the final leg down of the bear and create the better buying opportunity, hopefully sometime in the first half of 2023, as the market begins to look through the trough and rally back to be positive on the year.

We’re not at that trough yet—we’re not even at the cliff’s edge to see how deep the trough is—but it is approaching. You wouldn’t know it by how markets have continued to run, in part thanks to the January effect, an observed seasonal increase in stock prices during the month that’s particularly apparent following an aggressive tax-loss selling period.

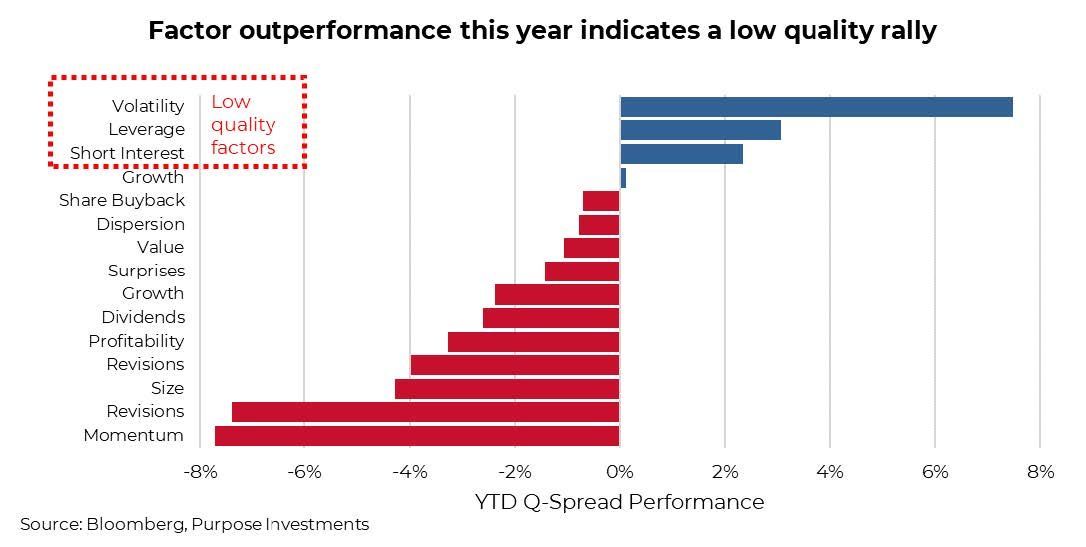

There was no shortage of losses to investors to sell last year, especially in some of the more hard-hit segments of the market. It’s not surprising that some of those hardest-hit segments have been the biggest winners so far this year. Cyclicals have been big winners, and from a factor perspective,

the three best-performing Bloomberg Factors based on a Q-Spread (long first quantile, short last quantile) are 3M Volatility, Leverage, and Short Interest. Value, Dividends, Size, and Profitability have all lagged.

On the whole, market performance so far this year has been better than we expected. The S&P/TSX Composite is up 5.3%, the S&P 500 is up 2.3%, and the NASDAQ is up 4.9%. International shares, which we’ve been recommending as an overweight since last summer, have had a great run. Europe is up 8.5% YTD, and the Euro Stoxx 50 index is up 24% since the end of the third quarter. China moving past the zero Covid policy has disproportionately helped European shares, as the region is more closely tied to China and global growth compared with the U.S.

We continue to like Europe, but at this point we’d caution adding given the recent outperformance as seen in the chart below. Some markets like the U.K. have also recently hit new all-time highs! It would appear with the abundance of China optimism floating around that markets have gotten ahead of themselves.

Technicals

The S&P 500 now finds itself at a critical juncture. It’s now up against the key downward-sloping trendline as well as the 200-day moving average, which have both proven to be stiff resistance levels. For more tactical and technically oriented managers, it’s at a logical place to begin considering de-risking.

Momentum indicators, such the Relative Strength Indicator (RSI), are also not breaking out, indicating momentum may not be strong enough to break above overhead resistance. At present, the market has not shown any clear technical signs of breaking out of the bear market trend. There are some positives worth mentioning. Breadth is decent, the equal weight index is showing more relative strength, and the market is continuing to make fewer 52-week lows on the last couple of pullbacks.

Value and Dividends remain attractively priced, and we like their defensive characteristics, but our third major portfolio tilt should be put on the back burner at present and await a better opportunity. With markets taking a victory lap over the perceived victory over inflation, the mood in corner offices remains foreboding with caution in the air and job cut announcements beginning to pick up. The word “recession” will be a hot topic as earnings season heats up, and while equity valuations remain depressed, the recent move higher in stock prices warrants a degree of caution.

Bad news may be bad news again

Inflation was clearly the biggest problem for markets last year: the uncertainty about how high it could go, how long it might last, and what the central banks would do to fight it. This uncertainty has been improving of late. Inflation has started to come back down, and investors have a reasonable idea of how far central bankers will go as some have started slowing the pace of hikes.

Helping fuel the view that inflation is coming back down isn’t just in the monthly CPI and related inflation data releases, it has also been in the data showing the economy slowing. For months now, weak economic data was welcomed by the markets, which feared inflation uncertainty over economic recession uncertainty. This was the bad-news-is-good-news environment.

But that may be starting to change back to a more normal “bad-news-is-bad-news” again. Inflation is still likely the biggest issue but we have seen a number of trading days that experienced soft economic data coinciding with weak markets—clear evidence the transition may have started.

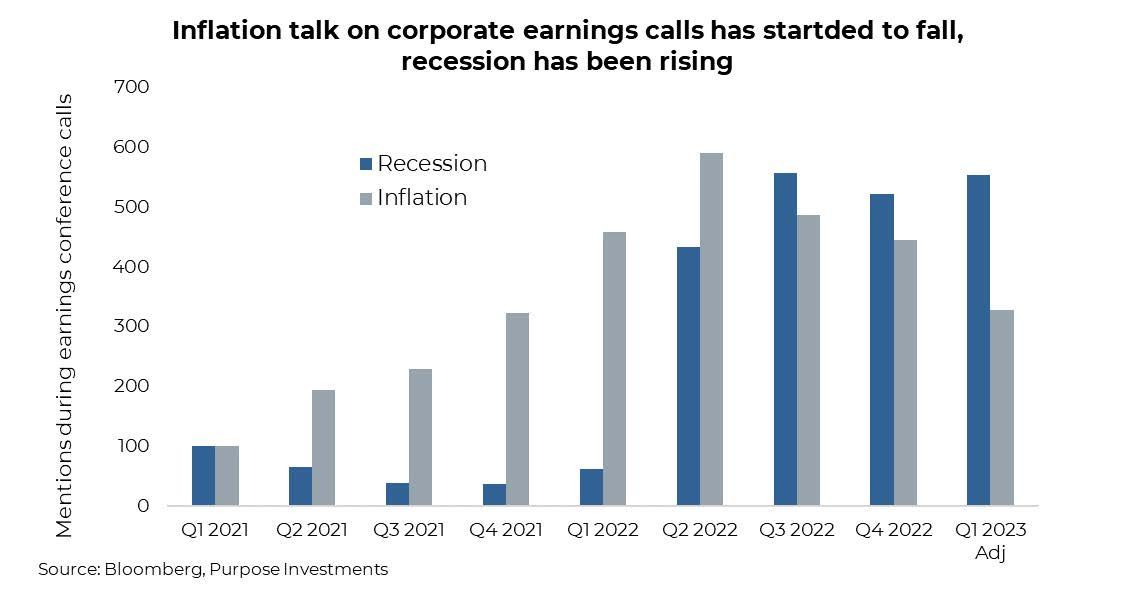

We have already seen this transition at the company level. Analyzing corporate earnings conference calls, we have seen a significant drop in management commenting on “inflation.” Meanwhile mentions of “recession” have been on the rise. [Q1 2023 is adjusted as the earnings season is only partially complete.]

Portfolio Considerations

Markets are taking a victory lap over the perceived victory over inflation, China’s re-opening, and Europe is apparently avoiding the energy crisis. But we are not convinced these things lasts. The mood in corner offices remains foreboding with caution in the air and job cut announcements beginning to pick up. The word ‘recession’ will be a hot topic as earnings season heats up and while equity valuations remain depressed, the recent move higher in stock prices warrants a degree of caution. “Beep Beep” doesn’t just mean that the goal is close at hand—it’s warning of more pain, whether it’s falling off a cliff or the dreaded ACME anvil.

— Derek Benedet is a Portfolio Manager at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.