Nobody Controls Risk in an Index

Nobody Controls Risk in an Index

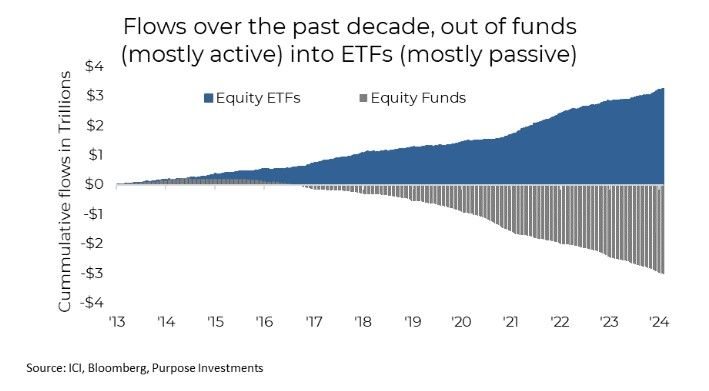

There has been much chatter over the past couple of weeks about the rise of passive investing distorting the market, increased concentration and resulting in less price discovery – I would certainly encourage folks to listen to the Masters in Business February 8 podcast with David Einhorn with the caveat that his views are certainly at one end of the spectrum, albeit with some rather

compelling points. The steady redemptions over the years from active managers and reallocation to passive have created more steady selling pressure in strategies that focus on value or fundamentals. Meanwhile, increased flows to passive are resulting in more of a momentum trade. Passive index strategies never met a PE ratio they didn’t like.

We don’t believe this has broken the market but would certainly concede it has made markets a lot more risky. You have likely read reports highlighting the concentration risk in the S&P 500, driven by the Magnificent 7 (or whichever moniker they are going by today). Today, these few names comprise about 30% of the largest equity market in the world. And over the past year, with the S&P 500 up 18.6%, 9.1% of this rise is attributed to those 7 names. Safe to say the S&P 500 is rather concentrated, and leadership is rather narrow.

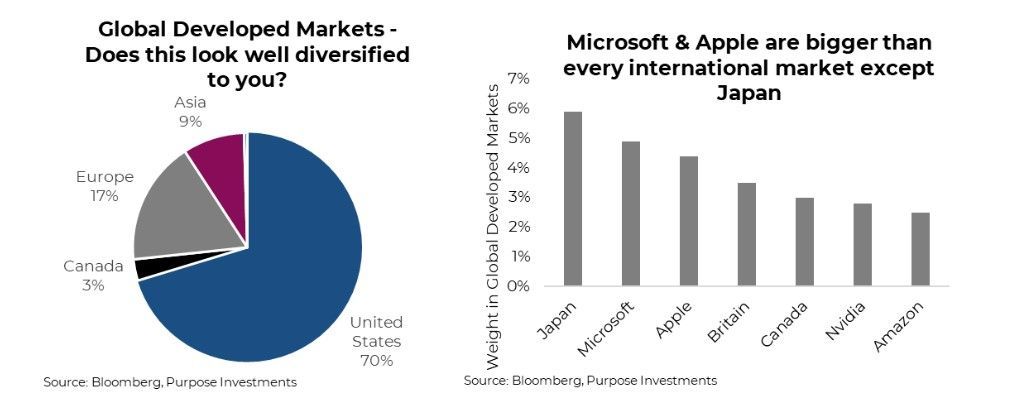

In fact, this concentration, coupled with US equity market outperformance over the past decade, has really distorted even the global equity markets. If someone were to buy a capitalization-weighted index capturing all equities traded in developed markets, that does sound like it would be well diversified. Sadly no. The Bloomberg Developed Market index currently carries a 70% in US equities. Clearly, my old rule of thumb that global markets were 50-55% US, 30% Europe, and the rest spread out is antiquated.

Equally incredible – Nvidia is now roughly the same weight as Canada. Microsoft and Apple are roughly the same weight as all of Asia. This naturally leads to thinking this is tech bubble 2.0, referring to tech bubble 1.0 as the 1990s internet bubble. Concentration is similar, the US equity weight globally was also similar and performance being driven by a narrow handful of names is similar. However, the 1990s was dominated by telecom equipment names, the builders of the internet backbone. This was much more narrow than today. Simplifying each company’s many business lines, Apple is a device maker, Microsoft is software/cloud, Nvidia is a semiconductor maker, Amazon is a fulfillment/cloud company, while Google and Meta sell digital ads. It is a more diverse business than the 90s tech bubble leaders.

And let’s not forget, these companies have earnings, material earnings at that. Across the Mag 7, they have trailing pretax income of over $400 billion. That is a far cry from valuations in the late 1990s when new valuation metrics such as price to eyeballs were being bantered around given a lack of actual earnings.

In fact, today’s market probably has more similarities to the nifty 50 than the 1990s tech bubble. For those not familiar, the nifty 50 was a bubble in high-growth stocks that ran from the late 1960s to the early 1970s. It was a decade led by growth over value (similar to today), and the growth names became dominant in the index as they grew faster over time (again, similar to today). The names in the nifty 50 were pretty diverse, including General Electric, IBM, Coca-Cola, Xerox and, of course, Avon Products & Polaroid.

The nifty 50 were called one-way stocks; you just had to own them, and valuations didn’t matter. Furthermore, portfolio managers had to own them to keep up with the index. Sound familiar? Today, there are more and more managers altering their strategies to incorporate some Nvidia or Amazon, simply trying to keep up with the index. And there is a cohort that believes these companies are recession-proof, given their handling of the 2020 pandemic-induced recession and strong balance sheets. We believe that view is misguided, and the pandemic recession was a unique confluence of events that hopefully won’t happen again during our investment lives.

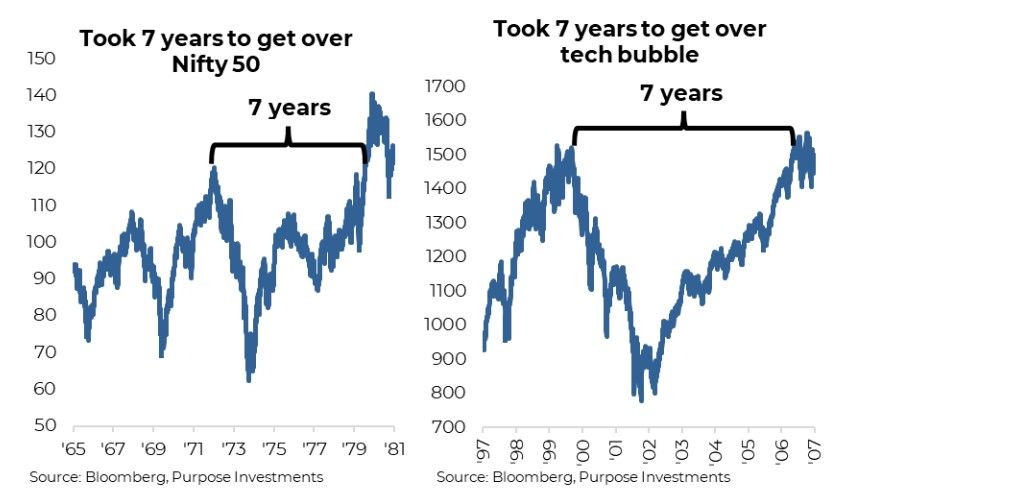

So what ended the fifty 50 era? Two things: inflation and a recession. This combination dispelled investor’s view that these companies had such great prospects they had become immune to the business cycle. Given the high concentrated weight in the index of those growth names, it led to a seven-year drought without the index making a new high. Rather similar to the drought of new highs following the tech bubble of the late 1990s.

We like both active and passive strategies, really depending on the market and the desired exposure. Still, it’s imperative to know the underlying exposures in both active and passive strategies. Most passive strategies, often in ETF form, are tracking market capitalization-weighted indices. That means whatever trades on the market or sits in that index carries a weight, given the size of the company. There is no committee that says the S&P 500 has too much technology (29%) or too little energy (4%). Or for the TSX with 31% financials and 0.3% health care. Nobody controls the risk in an index, which is why it remains important to understand the exposures and how they combine with the rest of a portfolio. Hence, if you want more international exposure,

the World Index is not the answer.

Final Thoughts

This does have the characteristics of a bubble. The unknown is whether it has a few years to go before peaking, or a few months or only days. One could easily argue that the nifty 50 and tech bubble ended simply because they went too far. Expectations had become so high that any stumble would have a significant blowback on the share prices. Recession simply causes more companies to stumble around at the same time, even if in different industries. Whenever it does end, there is likely going to be a long hangover.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be

construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice. The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction. This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security