A Job-Filled Recession?

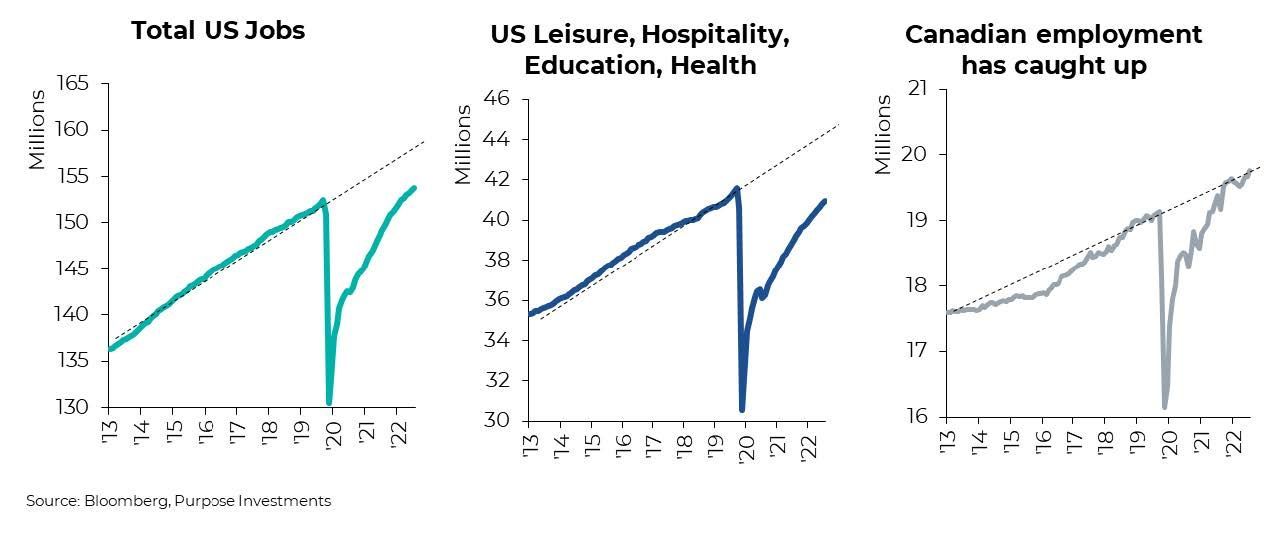

The jobs reports of last year and the final December reading that came out on Friday, respect. The U.S. economy added 223k jobs, unemployment dropped to a multi-decade low of 3.5% (lowest since 'the 60s), and even the participation rate ticked up a little. That is 4.5 million jobs added during 2022. For comparison, the average from 2010-2019 was around 2.2 million jobs. Of course, the economies of the world are still recouping jobs in a number of categories as we all move back to 'normal.' The first two charts below show total U.S. employment with a 'really simple' dashed line that one could argue would hold if the pandemic hadn't happened. The biggest gap is in Leisure & Hospitality and Education & Health, which are still missing jobs. The final chart is Canadian employment, which appears to have recovered better, back to trend.

Let's take employment data with a grain of salt in 2023, then. Or at least don't suffer from lazy headline reading and dig a little deeper. We may need a little more salt in the opposite direction when looking at manufacturing. Currently, the five Market Cycle indicators we monitor for the health of manufacturing are all negative. These include purchasing managers, manufacturing & new order surveys, energy demand, trucking demand and rail volumes.

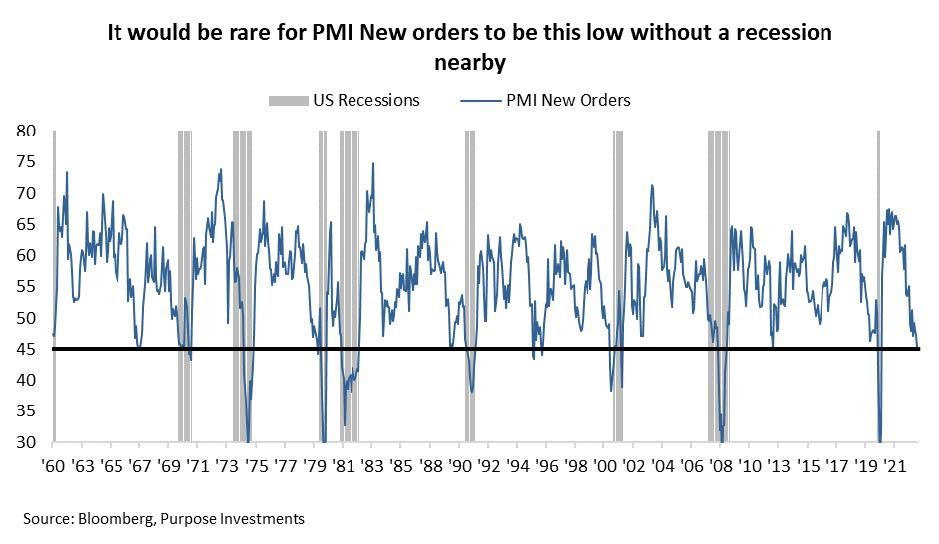

Purchasing managers surveys (PMI) are a diffusion index where, not surprisingly, purchasing managers are asked if they expect to be busier or less busy next month. A score of over 50 means over half said they would be busier, and a score under 50 more said less busy. Among the 16 biggest economies in the world, ALL 16 WERE ABOVE 50 IN JUNE . That is party time on the assembly line. A mere six months later, only 4 are above 50, and those 4 are smaller in the developing economy subset. The U.S., China, Japan, Europe, and Canada are all below 50 now. We could do a chart, but it's just a bunch of lines going down and to the right.

So why the grain of salt, you may ask. Well, if you recall, we had a bunch of bottlenecks, shortages, yadda yadda yadda in the past couple of years. No doubt manufacturing activity was ramped up to catch up with demand. So, is the clear slowing of global manufacturing activity a precursor of a recession or simply coming down from temporary high activity levels that were playing catchup. Chances are, it is somewhere in between. On a sobering note for the U.S., New Orders have fallen so far that it would be very strange if a recession was not nearby.

Still, the warnings are growing louder. Interest rate hikes started 10-12 months ago, depending on which country you look at. Some estimates have rate hikes taking nine months to broadly impact the economy, which means the pain is just starting. And don't forget, markets are down, and inflation sapped buying power, making us all poorer/less rich. That wealth effect also has an economic lag, which is probably coming.

The NY Fed and Cleveland Fed's recession probability models have certainly rung the alarm bell. In the past few months, they have spiked from 'all clear' to 'oh oh.' Those annotation labels are ours, not the bank's.

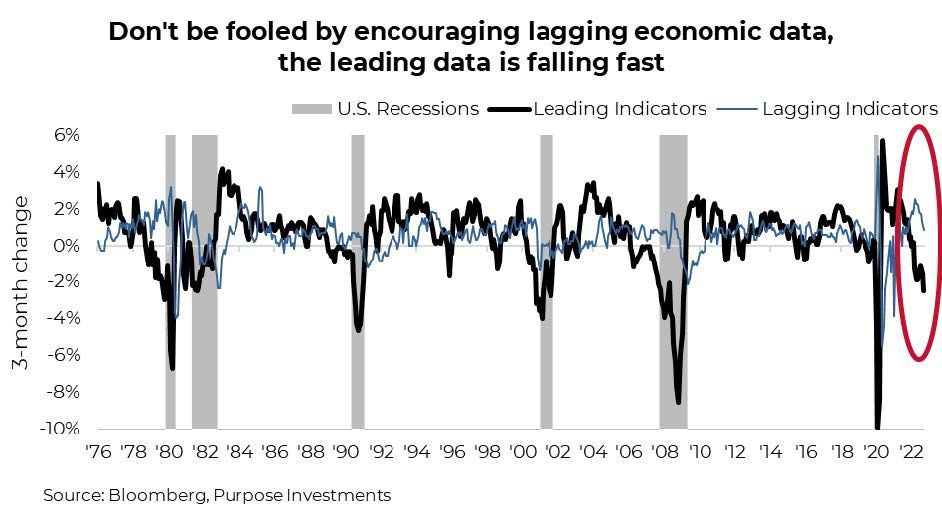

Leading indicators as well are troubling. In the chart below, we included the lagging economic indicator index, which continues to show positive growth. If you look at past recessions, the pattern is pretty clear. The leading indicators drop first, and the lagging often doesn't drop until the recession has started.

To be clear, there is no recession today. U.S. GDP is positive and could even surprise when we see the print for Q4. We nitpick the jobs data, but a job is a job, another consumer who will likely be a more robust spender. Perhaps this helps soften the slowdown. Perhaps China's removal of covid restrictions helps global growth. Would a Fed pause create a market with more certainty, encouraging housing activity and business spending? And many of these warning signs could prove to be early.

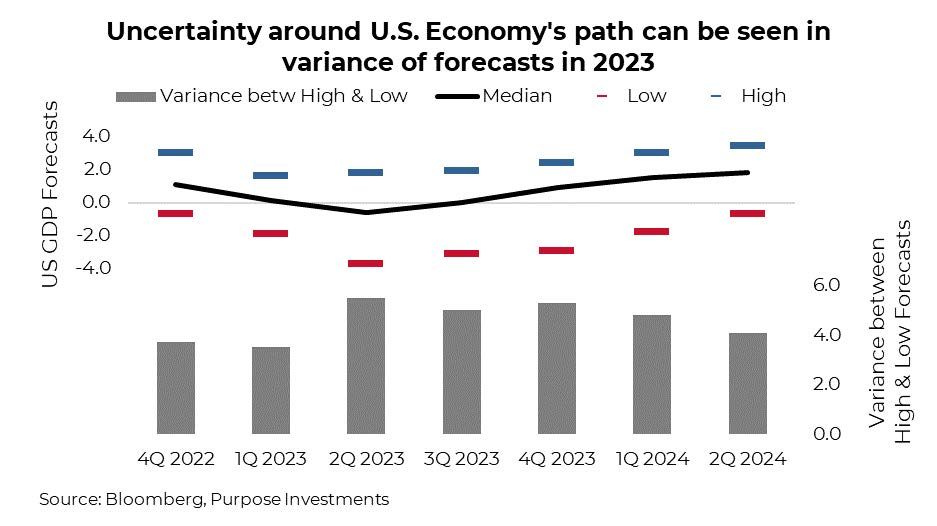

There are strong points on both sides, and this can also be seen in the divergence in economic forecasts. The chart below is based on economists' forecasts for U.S. economic growth. The green and red bars are the high and low estimates, with the line as the median. The bars are the difference between the high and low, which becomes pretty wide in mid-2023. For instance, in Q2, the high forecast is 1.7% growth, with the low at -3.7%.

Portfolio Considerations

We continue to believe a slowdown will materialize in 2023, which very well could manifest itself into a recession. We are leaning more towards the recession camp. The signs are clearly there. This has us tilted more towards defence and holding extra cash. The follow on question becomes, at what point will the equity and bond markets begin looking through the recession out the other side. We believe that point will come sometime this year, but it is not today. You can't look across the valley until you get closer to the edge.

— Craig Basinger is a Portfolio Manager at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.