Economists Vs Analysts

Economists vs Analysts

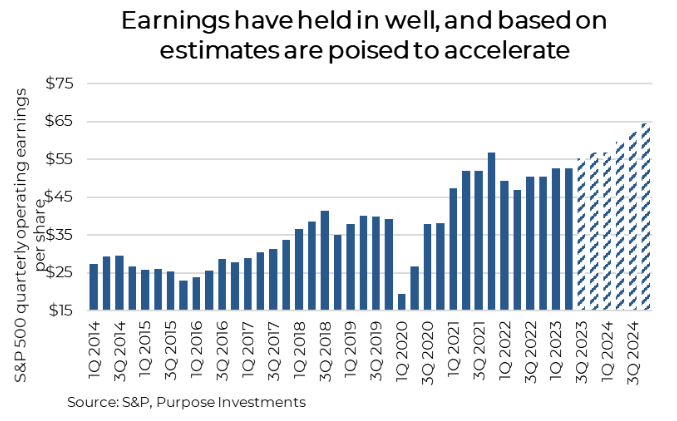

Here we are again — closing out Q2 earnings season for the U.S. and Canadian equity markets. The S&P 500 is now over 84% complete, and keeping with standard practice, has seen positive surprise rates of about 80%. As inflation continues to be a positive for corporate earnings — combined with an economy that keeps on chugging along, it’s a decent earnings season.

Q2 S&P 500 earnings are sitting at about $52, roughly flat with last quarter and up a little from Q2 2022.

On an optimistic note, based on current estimates, earnings are poised to accelerate in the coming quarters. The positive economic growth and weaker USD has resulted in analysts remaining a bit more upbeat. Of course, the big question will be the

economy. There is no denying that the stock market and the economy have a very loose relationship, often moving in opposite directions at times. However, earnings and the economy have a much stronger relationship. So, these estimates really come

down to the direction of the economy.

So, everything is looking good right? Not so fast. These are bottom-up analysis forecasts that are, let’s just say, influenced rather heavily by individual company guidance. Companies are always most often optimistic about the future. Even if the CFO is worried about a slowing economy, do they bake that into their guidance or do they rely more on what is happening today? Since forecasting the economy is not easy or accurate, most extrapolate today into tomorrow. Especially if today is a good

news story.

Here is where things don’t really add up. From the data above, earnings are about to start expanding at about a 10% growth rate compared to last year’s levels. Meanwhile, economist consensus forecasts for the U.S. economy have real growth 1.6% in 2023 and slowing to 0.8% in 2024. That trend is slowing, not accelerating. Now this is real growth, meaning it is adjusted for inflation. And earnings are nominal, so inflation is actually a positive.

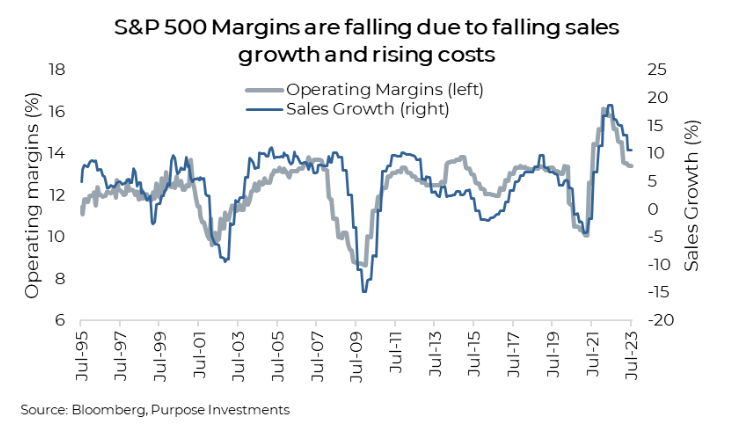

But here too, things don’t add up. Inflation, which you would add on top of real economic growth, is forecasted to be 4.1% in 2023 and slowing to 2.5% in 2024. Add these up, economist say nominal GDP growth is 5.7% in 2023 (1.6+4.1) and 3.3% in 2024 (0.8+2.5). That is deceleration, not acceleration.

Now this is pretty loose math. Companies have operational and financial leverage that can magnify changes in economic activity which makes its way to the bottom line. Markets are levered. But with higher interest costs and rising wages, these leverage multipliers are likely diminishing. This is evident in corporate margins which have been steadily falling.

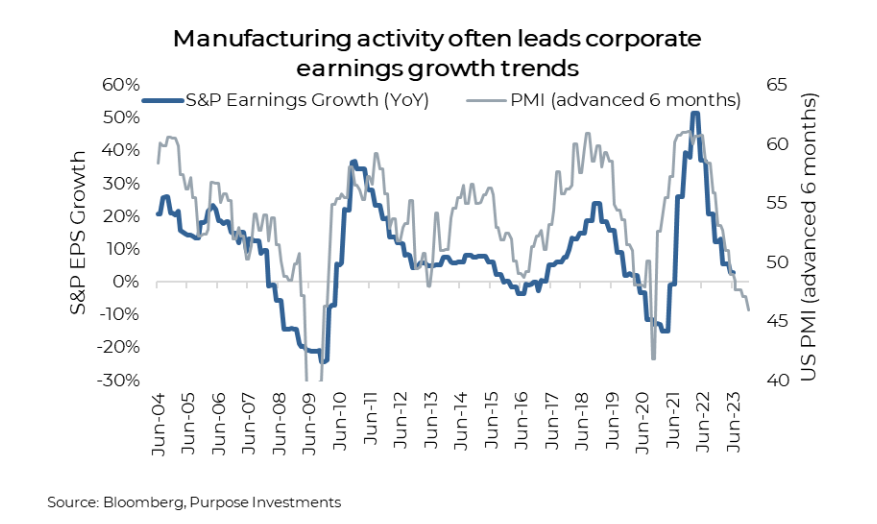

Let’s throw another twist into the economist vs. analyst disagreement. The economy is largely driven by consumer spending, yet the stock market is more tilted to business spending. As a result, corporate earnings are actually more sensitive to manufacturing and other cyclical parts of the economy, regardless of what the consumer is up to. As a result, PMI (Purchasing Managers Index) has a long history leading the trend in corporate earnings growth. In fact, earnings growth trends in six months match pretty well with PMI surveys today (we pushed PMI to the right by six months in this chart). The bad news is PMI keeps going down, meaning bad news for earnings growth.

Final Thoughts

There are other factors that influence S&P 500 corporate earnings such as the global economy or changes in the U.S. dollar, etc. Clearly we are faced with a situation where consensus analysts are optimistic about the future of corporate earnings while the views from economists paint a much more tempered path forward. Who is right and who is wrong? Only time and the path of the economy will tell. But hats off to analysts for being more correct so far in 2023!

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction. This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any

securities, nor is it a recommendation or solicitation to buy, hold or sell any security