Thematic ETFs Are Missing Something

I suppose that is part of the appeal of thematic-focused funds and ETFs.

If we can get in on a long-term secular change or trend in society, that can be very profitable tailwind.

The iPhone launched in June of 2007 when Apple was trading at $4.36 per share; today it’s over $150.

Thematic ETFs are not just technology focused—really they are attempting to capture any long-term trend or change in society. Rising food consumption has led to agriculture thematic ETFs; there are clean energy, water, infrastructure, millennial-spending pattern ETFs…the list goes on. And who knows, maybe artificial intelligence is the next smartphone.

I did ask ChatGBT this question, the response was rather positive on the theme.

Then again, when asking AI about the future of AI, what else would you expect.

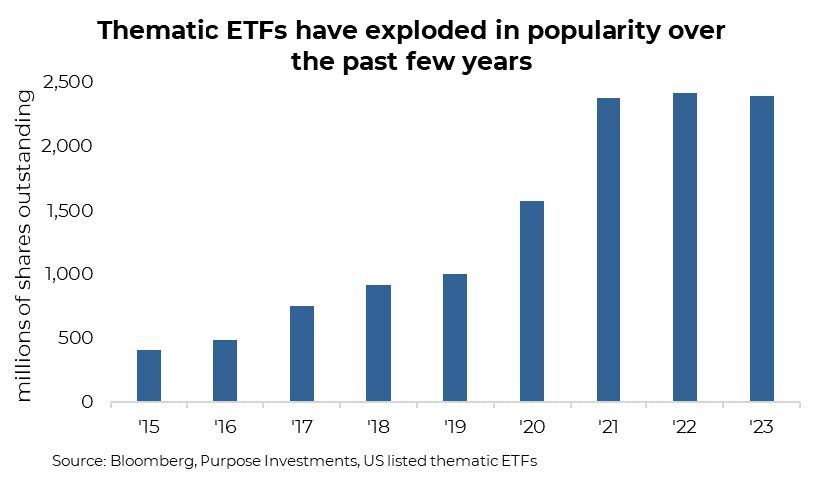

The asset flows and popularity of thematic ETFs have exploded over the past few years. Of the 315 thematic ETFs currently trading in the U.S., only 67 were in existence five years ago. Measured another way, the chart below shows the total shares outstanding across all thematic ETFs over time. Since as investors buy an ETF, it increases the number of shares outstanding, this is a good measure of rising demand.

Us humans love a good story and story-selling is very powerful. Thematic ETFs clearly lend themselves to a great story. There are more computer hacks today than any time in history and society continues to put more information in the digital world. Invest in cyber security, no brainer. The latest League of Legends championship (that is a video game) had 18,000 people in live attendance to watch the gamers battle, which is about the capacity of Scotia Arena. DRX won. E-gaming is a rising thematic trend. The International Energy Agency predicts 58% of vehicle sales in 2040 will be electronic vehicles (EVs). The long secular trend away from internal-combustion-engine vehicles to EVs is clear: why not use an EV ETF to gain some exposure to this trend?

Please don’t take the above statements as a recommendation—just trying to demonstrate how compelling the story-selling can be even with a couple sentences. They are exciting, even fun to talk about. Certainly more exciting than a North American dividend ETF that focuses on free cash flow, dividend health, and growth. Yawn.

But there appears to be a problem.

Investors are clearly aware that an investment strategy focused on a narrow theme is not diversified and will likely be much more volatile than the overall market. That is part of the appeal, if you believe the thematic trend will persist then hopefully more of that heightened volatility will be the good kind (aka up). The good news is that has been the case.

We took the current 50 largest thematic ETFs and did a bunch of analysis. We know, some survivor bias here, and there is a high degree of time sensitivity to this. Still, there are some really important lessons that shine through:

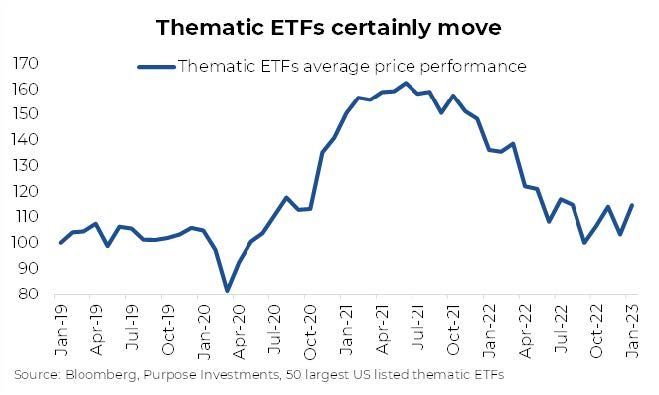

Volatility – As promised, thematic ETFs certainly move a lot. Initially we looked at the past three years, but that analysis started in the middle of the pandemic bear of 2020. So we expanded to four years to provide a better look. The chart below is an index created by using the average performance across the biggest thematic ETFs that have been around since 2019.

It's clearly volatile in both directions, but this masks over the individual ETF performance. During these periods, the best was up +178% (29% annualized) and the worse was down -86% (-38% annualized). FYI the big winner was a clean tech ETF, and the big loser was marijuana. With this kind of divergence in performance, picking the right thematic ETF is REALLY IMPORTANT.

Rampant performance chasing – Unfortunately, a simple look at performance overlooks the biggest hurdle investors face when investing in thematic ETFs. With ETFs, it is very easy to measure investor flows. When did the majority of investors buy, at what price, what has been the average investor experience? It is sobering.

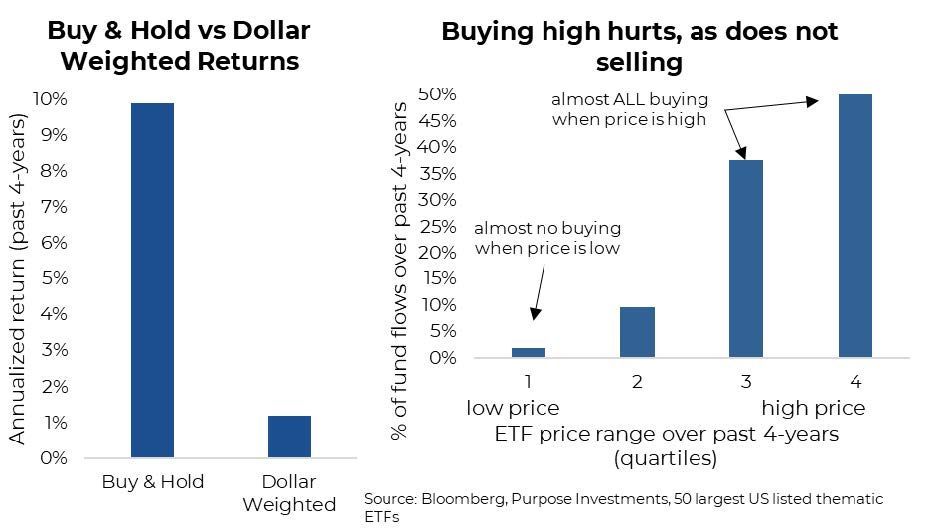

Of the biggest 50 thematic ETFs that have been around for four years (29), the median annualized price performance is about 10%. However, if you measure the internal rate of return based on when investors piled into each ETF the experience has been much, much worse. The median dollar weighted return is closer to 1%.

The reason behind this very wide performance spread can easily be seen when looking at the price most of the ETF buying occurred at. The right chart is the percentage of flows broken down by the individual ETFs price range over the four year period. With 50% of flows (dollars) coming in then the price is highest, not surprising the investor experience has not been ideal.

Full disclosure, this is somewhat caused by a ton of money coming into thematic ETFs late in 2021 during the speculative and highly elevated market environment. Subsequently, the price of most thematic ETFs have suffered in 2022. Still, performance chasing is very rampant in this space.

Thematic ETFs are missing something – There is nothing structurally wrong with thematic ETFs. The ETF manufacturer puts together a strategy that attempts to capture exposure to a long-term secular trend or potential trend. Sometimes these are active, sometimes they track a thematic index. There is clear demand for these types of strategies, and in our society, if there is demand supply will follow.

Even the worse-performing thematic ETF in our analysis achieved its objective. It remains a basket of companies most exposed to marijuana. Unfortunately, this space went from euphoric optimism to pessimism. The industry has grown, production has grown, (legal) weed usage has grown. The secular trend was actually spot on, yet the investment experience was poor over the past four years.

It would appear the missing ingredient for successful thematic investing is a sell discipline . Even if the secular long-term trend of a thematic is evident, the companies associated with the trend can oscillate around this trend from euphoria to despair. The trend may last for years or decades, but at some points the companies can be extremely highly valued to periods of much lower valuations.

We would agree that EV adoption will continue to rise and has continued to rise over the past few years. During this period, the DRIV ETF enjoyed +62% in 2020, +28% in 2021, and -34% in 2022. Clearly the market prices of companies levered to this trend enjoyed good times and bad times, even as adoption has continued relatively unabated.

Portfolio Considerations

Thematic ETFs have the ability to add exposure to a long-term secular trend for a portfolio. Even some excitement. But be careful of your entry point. Even if the world is going to change, trees don’t grow to the sky. And if euphoric excitement is already evident, you may be late to the party. More importantly, even if you still believe in the long-term trend, you need a sell discipline. This can be rules based, risk based, size based—take your pick. Even if the thematic trend is a long-term secular change and you believe deeply in the theme, thematic ETFs should not be used with a ‘buy-and-hold-forever’ mentality.

— Craig Basinger is Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.