Tightrope

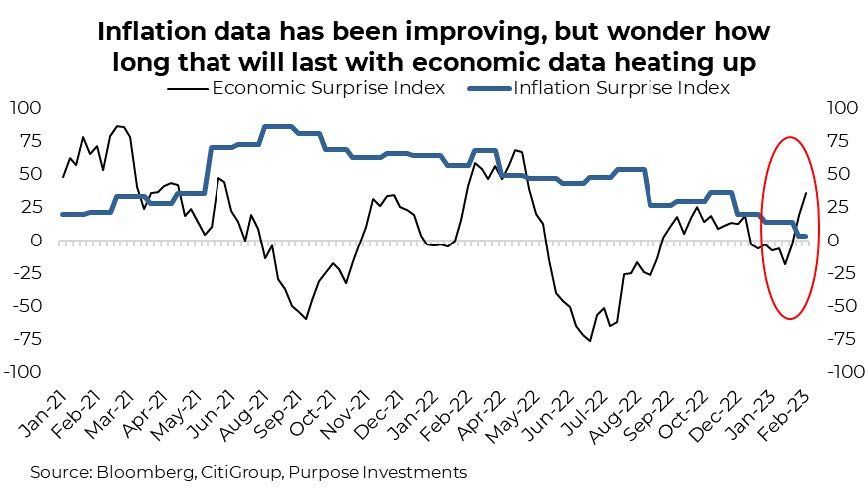

The strong market advance so far this year appears to be largely driven by improving news on the inflation front. That has helped the S&P and TSX rise in the 6-7% range. But so far in February, this advance appears to have stalled, and the likely reason is the economic data has been surprisingly strong. While this may reduce recession fears, it appears to be reigniting inflation fears. U.S. 10-year yields, which fell from 3.8% to 3.4% during January as equity markets rose, have risen in February back up to 3.8%. Canadian yields have followed a similar pattern.

The trends in the data are well captured by the CitiGroup economic and inflation surprise indices. The inflation index is monthly, so the last reading is from the end of January. With both U.S. Consumer Prices and Producer Prices coming in a bit hotter than expected, this will likely turn up a bit. Meanwhile, the economic surprise index has been suddenly rising. These are surprise indices, meaning it measures how the economic data come in relative to consensus economist forecasts. It appears the forecasts for inflation coming down may have gotten ahead of themselves, as did the forecasts for a slowing economy.

The path lower for inflation in 2023 was never going to be a straight, smooth line. Just as it moved higher in the second half of 2021 and 2022 was not a straight line up. And we may be in a reversal period at the moment. The duration is hard to say, but given the gradual loss of momentum in many of the more cyclical parts of the North American economy (housing, manufacturing), we continue to believe inflation fears will fade this year and gradually be replaced by recession or pace of economic growth fears.

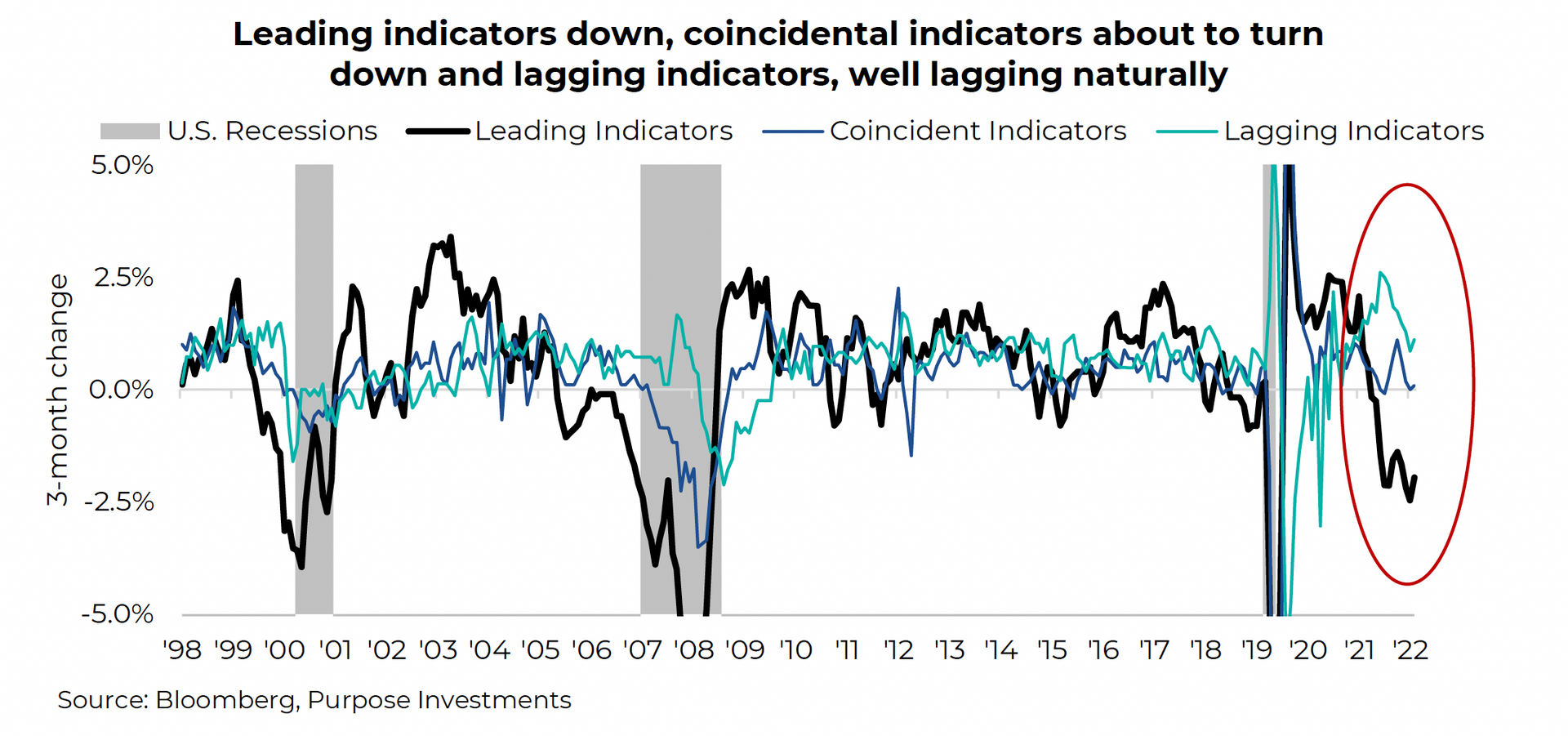

It isn't the most original analysis on our part, but there is no denying the U.S. Conference Board's leading, coincident and lagging indicators are all following a familiar pattern. The leading index is comprised of 10 pieces of economic or market data that have a history of turning ahead of the overall economy. Jobless claims, manufacturing new orders, building permits, and credit are a few of them. As is the stock market. The coincident index includes employment, business sales, personal income and industrial production. Lagging includes duration of unemployment, inventory/sales ratio, prime rate and services CPI, to name a few. Please note that services CPI is literally in the lagging economic indicators index. Inflation is very lagging.

Leading indicators were trending down in 2022. Maybe this is skewed because economic activity was so elevated in 2021 as the North American economy opened up more, and we were still catching up on supply shortages. So part of this downward move could be just 'normalizing.' Or the economy is about to slow down. Likely a combination of both, the world has never been simple or binary. Interesting that the coincident indicators tend to cross over to negative territory at the same time a recession starts. We should add that the onset of a recession (grey shaded bars) is not known in real-time; this crucial turning point is determined many months after the fact by the National Bureau of Economic Research.

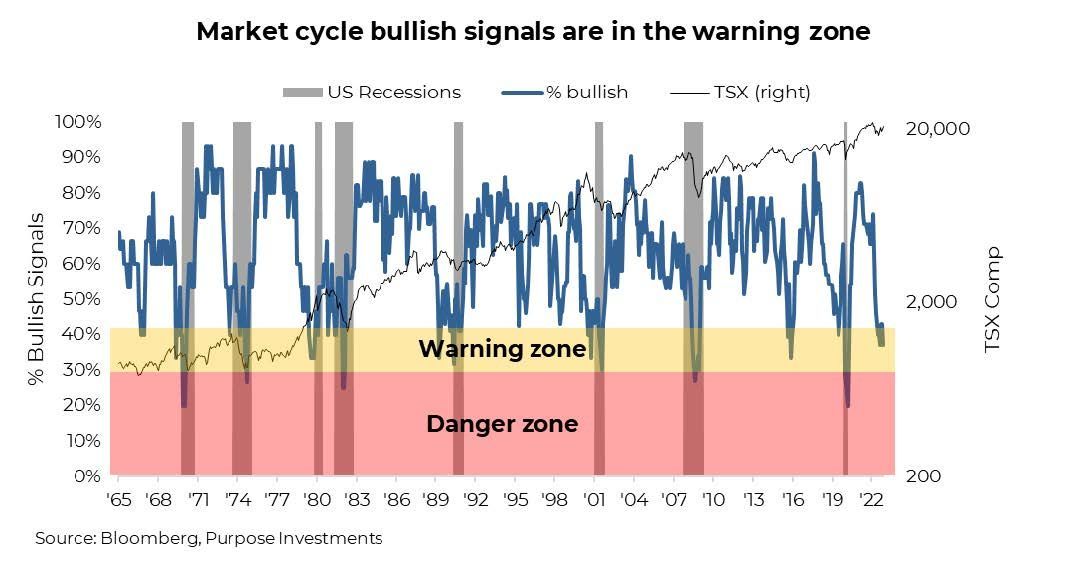

Moving to more of our in-house analysis, we have been using our Market Cycle framework for many years. This was developed to provide insight into the risk of an economic cycle coming to an end. Instead of just U.S. economic data, as is used in the Conference Board leading indicators, we incorporate many other data points – economic, yields, central banks, global economic activity, commodities, fundamentals, etc. All told, it tells a similar story. In our publication two weeks ago, we included the Market Cycle bullish indicators and all the specific inputs ( Rent This Rally, Don't Buy It ).

Below we share these indicators and framework looking back about half a century. Nothing is ever perfect, and how the economy works changes over time. But it provides insight into the economic cycle's health beyond just U.S. data. With the signals hovering in that danger zone, things are rather precarious.

Add to this a market that really isn't down all that much anymore…was it even a bear market? The S&P 500 is down 12.6% since the beginning of 2022, but take out those mega-cap tech giants, and it's down a mere 5%. Slicing and dicing an index like this isn't fair, but if a bear market largely punishes a few trillion-dollar mega-cap tech giants, that is not that painful. FYI – the TSX is down a mere 7% from its high, and Europe is down 2% from its all-time high.

Portfolio Considerations

Thematic The market, outside a handful of giant tech companies, is not really down that much after this rally of the past few weeks. Goodbye, valuation safety buffer. Meanwhile, inflation remains a risk, and so does an economic slowdown/recession. Given our Market Cycle and the Conference Board indices, we believe inflation fears will diminish as recession fears grow, even if inflation fear may be experiencing a little tick higher of late. This has lifted bond yields higher, 10-year at 3.85% in the U.S. and 3.30% in Canada, yet our fear of duration is incrementally lower. Dialling back market risk in return for duration risk seems reasonable.

On the left, you have inflation; on the right, recession. And given market levels, this tightrope is more than a few feet off the ground.

— Craig Basinger is Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.