In Need of Some Bad News

In Need of Some Bad News

Markets have enjoyed a great advance in June and July, thanks to a number of factors. Certainly, some hype around AI helped a few of the mega-caps, but it was much more pervasive. During those two months, the S&P 500, NASDAQ, equal-weighted S&P (adjusts for concentration), TSX and Europe were all up about 10% (common currency USD). Perhaps some of this advance was fuelled by a sudden change in sentiment, but it would appear more driven by some firming in the global economic data.

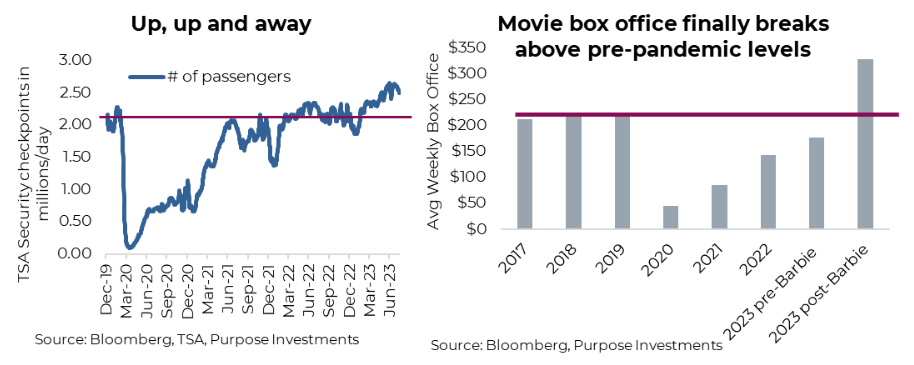

Of course, the star remains America!! Housing is humming along, enduring higher financing costs. Sure, manufacturing is in the dumps, but nobody seems to care because of the consumer. Resilience would be an understatement. Whether thanks to some dwindling stockpiled pandemic savings, an uptick in wages, or continued ease to find a job, the U.S. consumer remains in spending mode. Anyone who has flown recently would agree the prices are on the high side, yet the volumes going through TSA security checkpoints are now well above pre-pandemic levels. And in the past few months, box office numbers have finally broken above pre-pandemic levels (thanks, Barbie!!). Maybe there is some truth that Swifties and Barbie have pushed off the recession.

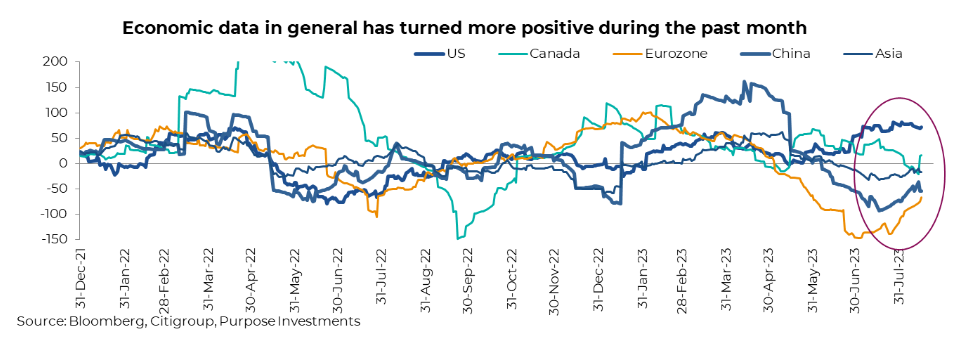

There has been an improvement in economic data beyond just the U.S. consumer. European data, which had been deteriorating since the start of 2023, turned more encouraging over the past month or so. Based on the Citigroup Economic Surprise indices, even China has shown some improvement, albeit from depressed levels. Meanwhile, Canada and the U.S. remain in positive surprise territory.

The improving economic data is generally a positive development as this helped alleviate concerns over near-term recession

risk. Adding to this good news, the May and June inflation data, which is released with a one-month lag in June and July, showed

continued cooling. Better economic data cooling inflation are a great combination for markets. This lifted the S&P 500 to 4,600, a

mere 5% below its all-time high set in back in January 2022. Global equity markets also rallied up to within 7% of their all-time

high, set around the same time as the S&P.

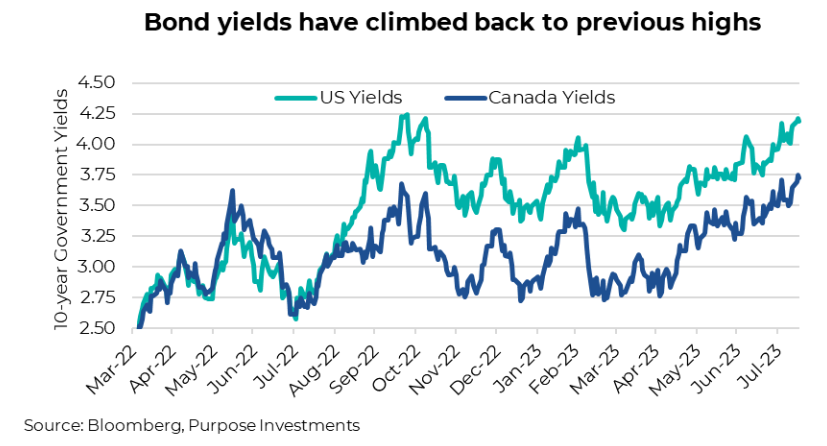

Herein lies the rub. The good news of better economic data, which lifted markets for a while, has started to become a negative

due to rising bond yields. It seems some good economic news is great, but too much good news is not. We could bring in the appropriate temperature of porridge, but not this time. 10-year yields in Canada and the U.S. have moved back up to previous

highs set in late 2022.

It is these higher yields that are weighing on equity markets in August. Hence our need for some bad economic news. Compounding the yield situation is the base rates on the inflation side are subsiding. Meaning that we could actually start to see CPI year-over-year measures tick up as the data from a year ago falls off.

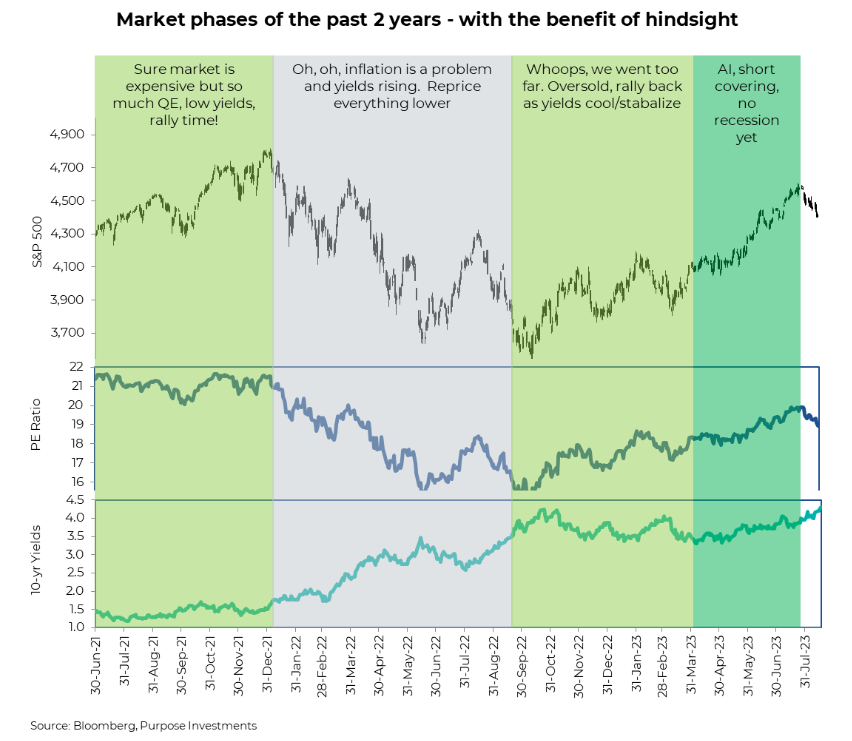

With the benefit of hindsight, the market of the past two years has gone through a number of phases. In 2021, quantitative easing, fiscal stimulus was flowing as the economy recovered and bond yields remained low. Put that into the market mixing bowl, and you get price appreciation. Then inflation proved to be less transitory, eliciting a central bank tightening response and a rapid repricing of assets (repricing = lower).

But as the market always does, it went too far. Especially given a recession had not begun. This led to a prolonged bounce back up. Then there was optimism around AI, short covering and improving sentiment – combined with some improving economic data pushing out the recession risk, and markets took another leg higher.

The problem now becomes we have a market that moved higher on a lack of fundamentals. Earnings have held in but certainly not growing or accelerating. Which means the rally was all multiple expansion. And now that the good economic news is leading to higher yields, the market valuation multiple is under pressure to come down. You may notice a near-perfect inverse relationship between 10-year bond yields and the PE of the S&P 500 in the above graph.

Final Thoughts

Good news is good news, but sometimes it isn’t. The biggest risk for the market today is if yields continue to rise, the valuation multiple will likely continue to fall via lower prices. Some softer economic data may cool yields, and provide a bit of a reprieve for the market, but that will bring recession fears back pretty quickly. The silver lining is maybe if you were thinking of adding to bonds but missed the higher yields of late 2022, well, it looks like there is another similar entry point. We would have to see better valuations than these to get us excited about adding to equities.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be

construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice. The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security